Advanced Loan Origination & Management System for Atlas

Introduction

In collaboration with Atlas Equifin Pvt Ltd, Metric Tree Labs successfully developed and implemented a comprehensive suite of applications to revolutionize the loan disbursal process. This case study highlights the key features and benefits of the FOS Loan Disbursal Mobile App and Atlas NBFC Admin Web, which have significantly improved the efficiency and effectiveness of loan management for Ecaps and its stakeholders.

Location

India

Industry

Finance

Platform

Web & Mobile

The Challenge:

Ecaps, a leading financial institution, sought to optimize its loan disbursal process by digitizing and automating various stages. The primary challenges included:

- Streamlining Communication: Enhancing communication channels between Field Sales Officers (FOS), borrowers, and the administrative team to minimize delays and improve transparency.

- Simplifying Application Submission: Providing FOS with a user-friendly mobile app to submit loan applications and manage loan listings seamlessly.

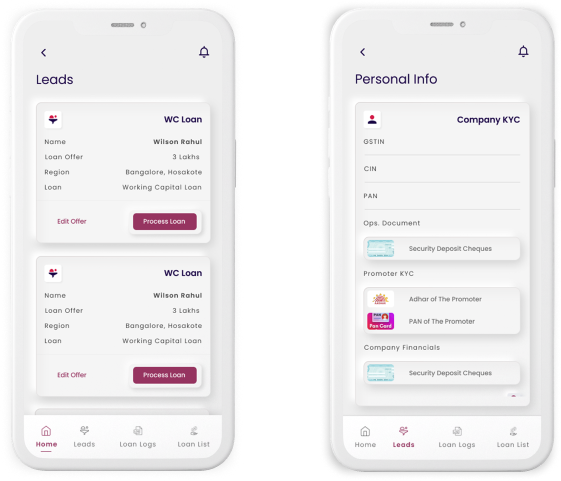

- Automating Loan Verification: Integrating advanced third-party solutions for e-KYC verification, credit score checks, and identity verification to ensure accurate loan assessments.

- Centralizing Administration: Developing an administrative web application for the NBFC admin to manage loan listings, generate pre-approved offers, and monitor loan applications, availed loans, and defaults.

The Solution

Metric Tree Labs collaborated closely with Atlas Equifin Pvt Ltd to design and develop four key applications that addressed the challenges mentioned above:

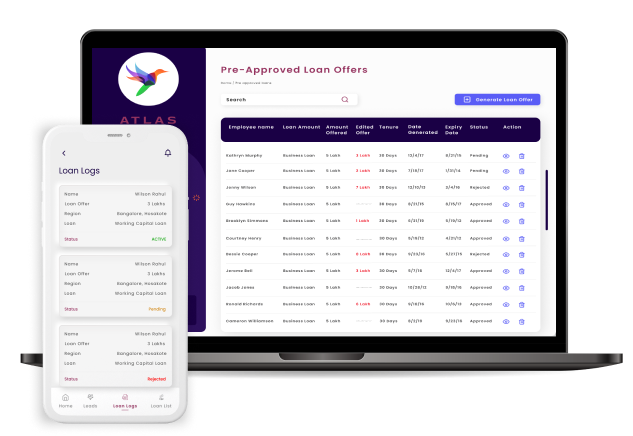

- FOS Loan Disbursal Mobile App: The mobile app enabled FOS to access a range of features, including login, profile management, lead generation, loan application submission, and loan listing management. It integrated advanced third-party identity verification and credit score check solutions to ensure accurate loan assessments and streamlined the application process.

- Borrower App: The borrower app empowered borrowers approved for loans by Ecaps. Borrowers could effortlessly login, view and edit their profile information, access loan details, create loan tranches, receive real-time notifications, and conveniently make loan repayments through the app.

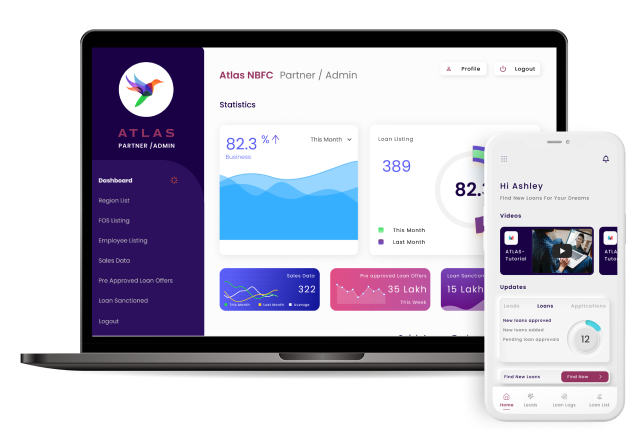

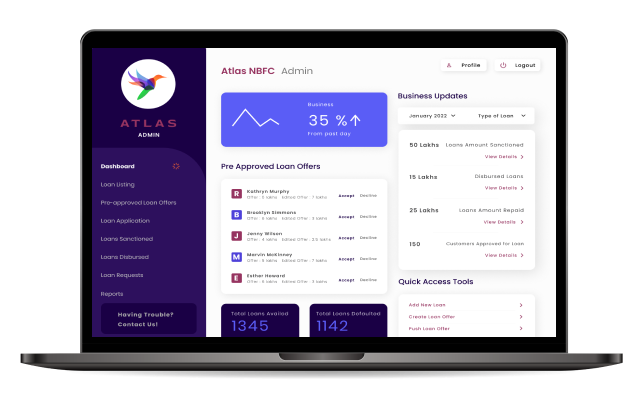

- Atlas NBFC Admin Web: The web-based application provided a comprehensive administrative dashboard for the NBFC admin. It facilitated login, data analytics through an intuitive dashboard, loan listing management, generation of pre-approved offers, loan application verification, and efficient management of availed loans and defaulted loans.

- Ecaps Admin Web: The administrative web application specifically catered to Ecaps’ administrative team. It enabled them to login, access a feature-rich dashboard with real-time data analytics, manage FOS and employee lists, invite FOS, track sales data and pre-approved offers, and monitor the status of availed and defaulted loans.

Technologies Used

The applications were developed using Python Django and React for web consoles and backend. React Native was employed for mobile app development. The team incorporated multiple advanced third-party integrations, including Digio for Aadhar-based identity verification and CIBIL for credit score checks. Moreover, loan repayments were automated through integration with multiple banking systems.

Benefits and Results:

- Improved Efficiency: The digitization and automation of the loan disbursal process significantly reduced manual efforts and processing time. FOS could seamlessly submit loan applications, while borrowers experienced streamlined access to loan information and repayment options.

- Enhanced Transparency: The applications fostered transparent communication among stakeholders, ensuring everyone had real-time access to loan status and updates.

- Accurate Loan Assessments: Integration with advanced third-party solutions for identity verification and credit score checks minimized the risk of fraudulent applications and enabled accurate loan assessments.

- Streamlined Administration: The administrative web applications streamlined loan management tasks, empowering the NBFC admin to efficiently manage loan listings, generate pre-approved offers, and monitor loan applications, availed loans, and defaults.

- Improved Customer Experience: Borrowers enjoyed a seamless and convenient loan management experience, resulting in increased customer satisfaction and loyalty.

Conclusion:

Metric Tree Labs’ collaboration with Atlas Equifin Pvt Ltd led to the successful development and implementation of the FOS Loan Disbursal Mobile App and Atlas NBFC Admin Web, transforming the loan disbursal process for Ecaps. The suite of applications streamlined communication, simplified application submission, automated loan verification, and centralized administration. These improvements resulted in enhanced efficiency, transparency, and customer satisfaction, propelling Ecaps to the forefront of the lending industry.